Strategic Storage Growth Trust II, Inc.

Overview

| Deal Type |

Mergers & Acquisitions |

|---|---|

| Client & Transactional Partners |

Strategic Storage Growth Trust II, Inc. SmartStop Self Storage REIT, Inc. |

| Our Role |

Exclusive Sell-Side Advisor |

Summary

On June 1, 2022, Strategic Storage Growth Trust II, Inc. (SSGT II) completed its previously announced merger with SmartStop Self Storage REIT, Inc. (SmartStop). KeyBanc Capital Markets served as Exclusive Sell-Side Advisor on the transaction.

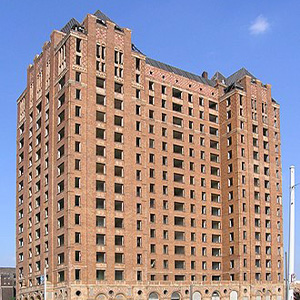

As a result of the merger, SmartStop acquired all of the real estate owned by SSGT II, consisting of ten wholly-owned self storage facilities located across seven states, an interest in one operating property held through an unconsolidated joint venture, and two properties in various stages of development that are held through an unconsolidated joint venture. The total SSGT II portfolio represents approximately 9,700 self storage units and 1 million net rentable square feet. The resulting consolidated portfolio consists of 152 wholly-owned operating properties representing approximately 11.7 million net rentable square feet and 102,000 units.

Strategic Storage Trust II was a public non-traded REIT focused on the acquisition of stabilized and growth self storage properties. SSGT II wholly-owned ten self storage facilities and one operating property held through an unconsolidated joint venture, which represents approximately 8,500 self storage units and 900,000 net rentable square feet of storage space, as well as certain development properties held in joint ventures in the Greater Toronto Area with SmartCentres REIT, one of the largest real estate investment trusts in Canada.