City of Huber Heights, Ohio

Overview

| Deal Type |

Debt Capital Markets |

|---|---|

| Size |

$56.2 Million Various Purpose Notes, Series 2025 (General Obligation) (Limited Tax) |

| Our Role |

Sole Manager |

Summary

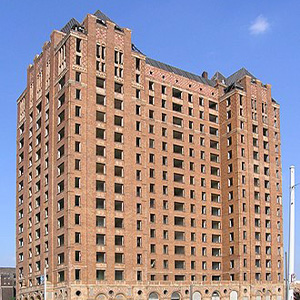

On June 26, 2025, KeyBanc Capital Markets (KBCM), as Sole Manager, and the City of Huber Heights, Ohio (the City), successfully closed a $56.2 million Various Purpose Notes, Series 2025 (General Obligation – Limited Tax) (the Notes) transaction. Proceeds received from the sale of the Notes will be used to 1) retire, with Note proceeds and cash in hand, Notes issued for the purpose of paying the costs of improving (a) the public works department, (b) city council facilities, (c) fire station facilities, (d) the Meadows infrastructure project, (e) public improvements; and (2) providing funds for City Hall renovations and the design of an indoor music center for community use.

Located just minutes from Wright-Patterson Air Force Base and Dayton’s commercial center, Huber Heights is home to over 800 businesses, from high-tech manufacturers to distributors. The residents of Huber Heights are spread comfortably over 25 square miles. Just over 38,000 residents of diverse backgrounds earn an average income of more than $69,000. The City is a community that provides an outstanding business environment that supports a high quality of life and an affordable cost of living coupled with abundant recreational and cultural amenities. A host of nationally acclaimed institutions of higher learning are within minutes of the City, including the Air Force Institute of Technology, several acclaimed universities (Cedarville, the University of Dayton Wilberforce, Wittenberg, and Wright State, among others). Together these institutions offer everything from advanced degrees to executive leadership training and lend to robust community amenities.

KeyBanc Capital Markets is a trade name under which the corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., member FINRA/SIPC (“KBCMI”), and KeyBank National Association (“KeyBank N.A.”), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and by its licensed securities representatives. Banking products and services are offered by KeyBank N.A.