Catawba Nation Gaming Authority

Overview

| Deal Type |

Debt Capital Markets |

|---|---|

| Size |

$240 Million Senior Secured Revolving Credit Facility |

| Client & Transactional Partners |

Catawba Nation Gaming Authority |

| Our Role |

Joint Lead Arranger Joint Bookrunner Syndication Agent |

Summary

On April 26, 2024, KeyBanc Capital Markets Inc. (KBCM) successfully closed on the syndication of a new $240 million Senior Secured Revolving Credit Facility for Catawba Nation Gaming Authority (CNGA), a tribal instrumentality of the Catawba Indian Nation. CNGA owns and operates Catawba Two Kings Casino in Kings Mountain, North Carolina. Proceeds from the Credit Facility will be used to finance the expansion of table games and for general corporate purposes.

About Catawba Indian Nation

Catawba Indian Nation is composed of ~3,300 enrolled members and is the only federally recognized tribe in South Carolina. The 700-acre Catawba reservation is along the bank of the Catawba River.

About Catawba Nation Gaming Authority

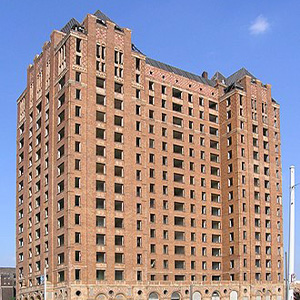

CNGA is the owner and operator of Catawba Two Kings Casino, which is located on tribal land in Kings Mountain, North Carolina, just over the South Carolina border. The initial 500-slot temporary facility opened in July 2021 and was built using 29 prefabricated modular trailers on a 17-acre site. An expansion of that facility with 500 additional machines opened in December 2021.

KeyBanc Capital Markets is a trade name under which the corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., member FINRA/SIPC (“KBCMI”), and KeyBank National Association (“KeyBank N.A.”), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and by its licensed securities representatives. Banking products and services are offered by KeyBank N.A.