Capital strategies in 2025: How middle market companies secure, spend, and save

Nearly half of middle market companies are actively pursuing capital to fund new initiatives, according to KeyBank’s latest Middle Market Sentiment survey. But how are leaders accessing capital, what are they spending it on, and where are they saving?

KeyBank’s July 2025 Middle Market Sentiment Report offers answers, drawing on insights from 762 owners and executives of middle market businesses across the United States with $10 million to $1 billion in annual revenue. The report shows how these leaders plan to obtain capital and where they plan to deploy it.

Three clear signals emerged from this data, each revealing how middle market leaders are rewriting the capital playbook.

Key insights driving capital strategy in 2025

1. Banks and private equity firms are go-to-sources for external funding

What middle market leaders are saying

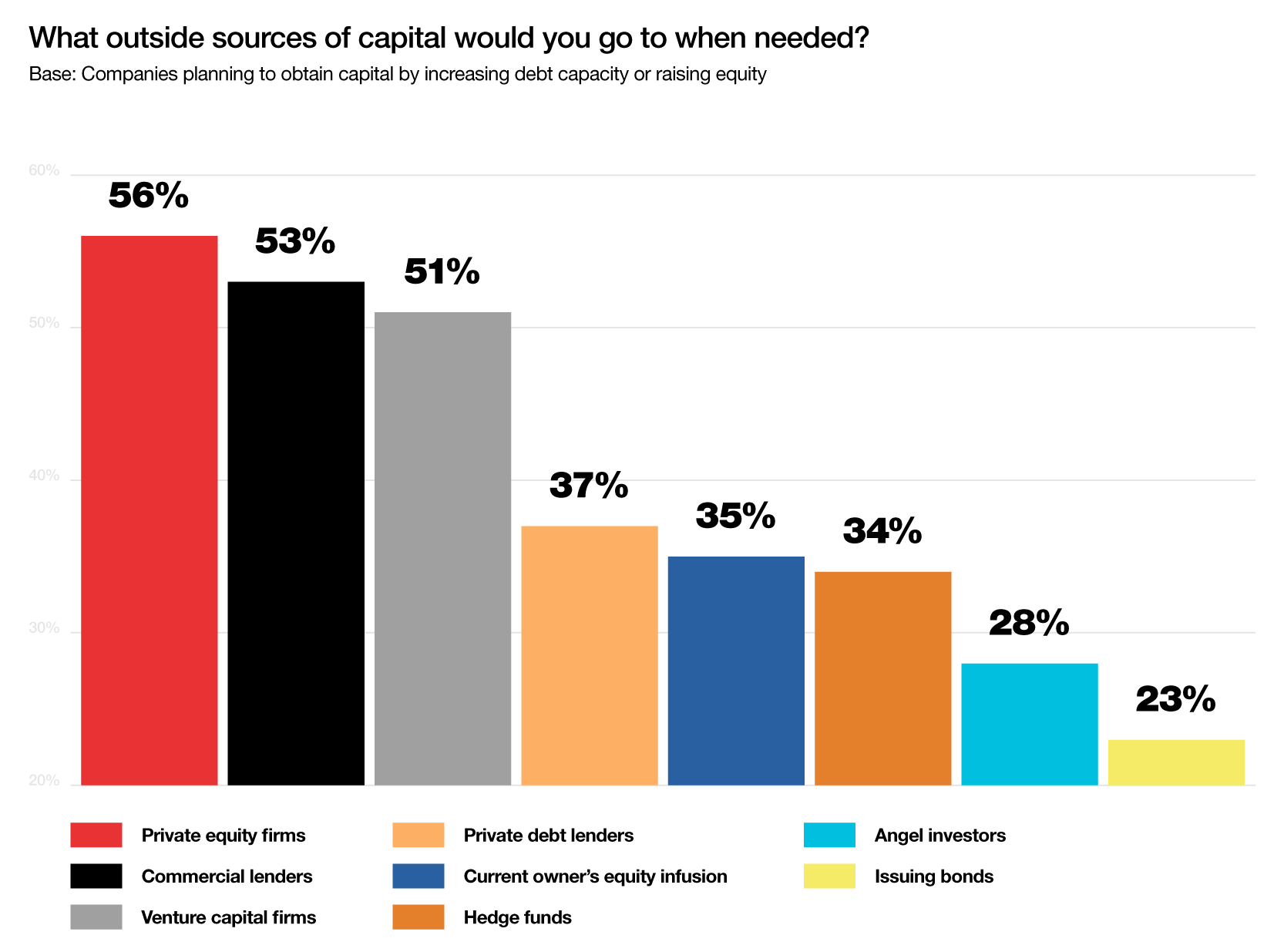

Leaders are taking a multi-pronged approach when it comes to accessing outside sources of capital. Many (53%) are turning to strong commercial banking relationships to expand their debt capacity. When it comes to strategic investment dollars, 56% of leaders are turning to private equity firms.

Specialized debt, owner reinvestment, and niche funds are still considered, but play more of a supporting role in capital strategies.

GRAPH 1 – What outside sources of capital would you go to when needed?

Base: Companies planning to obtain capital by increasing debt capacity or raising equity

Private equity firms 56%

Commercial lenders 53%

Venture capital firms 51%

Private debt lenders 37%

Current owner’s equity infusion 35%

Hedge funds 34%

Angel investors 28%

Issuing bonds 23%

What it means for you

Blending debt and equity sources allows companies to build a well-rounded capital strategy. Commercial lenders provide not only deep resources and predictable terms but also the advantages that come with their existing relationship, as many middle market companies already rely on their commercial banking teams for day-to-day operations. Full-service banking relationships enable lending teams to tailor financial solutions and strategic guidance that align with the business’s long-term goals.

The data confirms what we observe in the field: Companies still value commercial lenders for senior debt, appreciating predictable pricing, high-touch service, integrated payments, and relationship-driven, value-added banking solutions. At the same time, private equity is the go-to for transformational equity injections. Each source plays a distinct role, and using both creates a balanced, durable capital stack.

— Laurie Muller-Girard, KeyBank Commercial Executive

2. Cash flow discipline comes first — then outside sourcing

What middle market leaders are saying

Middle market leaders overwhelmingly cited improving cash flow as their leading strategy for obtaining more capital. These companies tend to maximize existing resources before turning to external financing.

They typically focus on tightening receivables timing, improving inventory turns, and optimizing payment terms, often alongside targeted cost reductions. Once internal efficiencies are realized, they consider raising fresh equity or expanding debt to support growth.

GRAPH 2 – When needed, how do you plan to obtain more capital?

Improve cash flow management 72%

Focus on cost reduction 49%

Raising equity 47%

Increasing debt capacity 42%

What it means for you

Before seeking outside capital, middle market leaders are focusing on what they can control, including:

- Accelerating receivables to improve liquidity without increasing debt.

- Streamlining inventory to unlock working capital and reduce holding costs.

- Negotiating more efficient payables to extend runway without straining supplier relationships.

These adjustments are clear indicators to lenders and investors that a business is disciplined, efficient, and ready to scale. By tightening internal cash flow performance, companies can help improve negotiating positions for future funding.

3. Capital is powering AI, cybersecurity, and stronger operations

What middle market leaders are saying

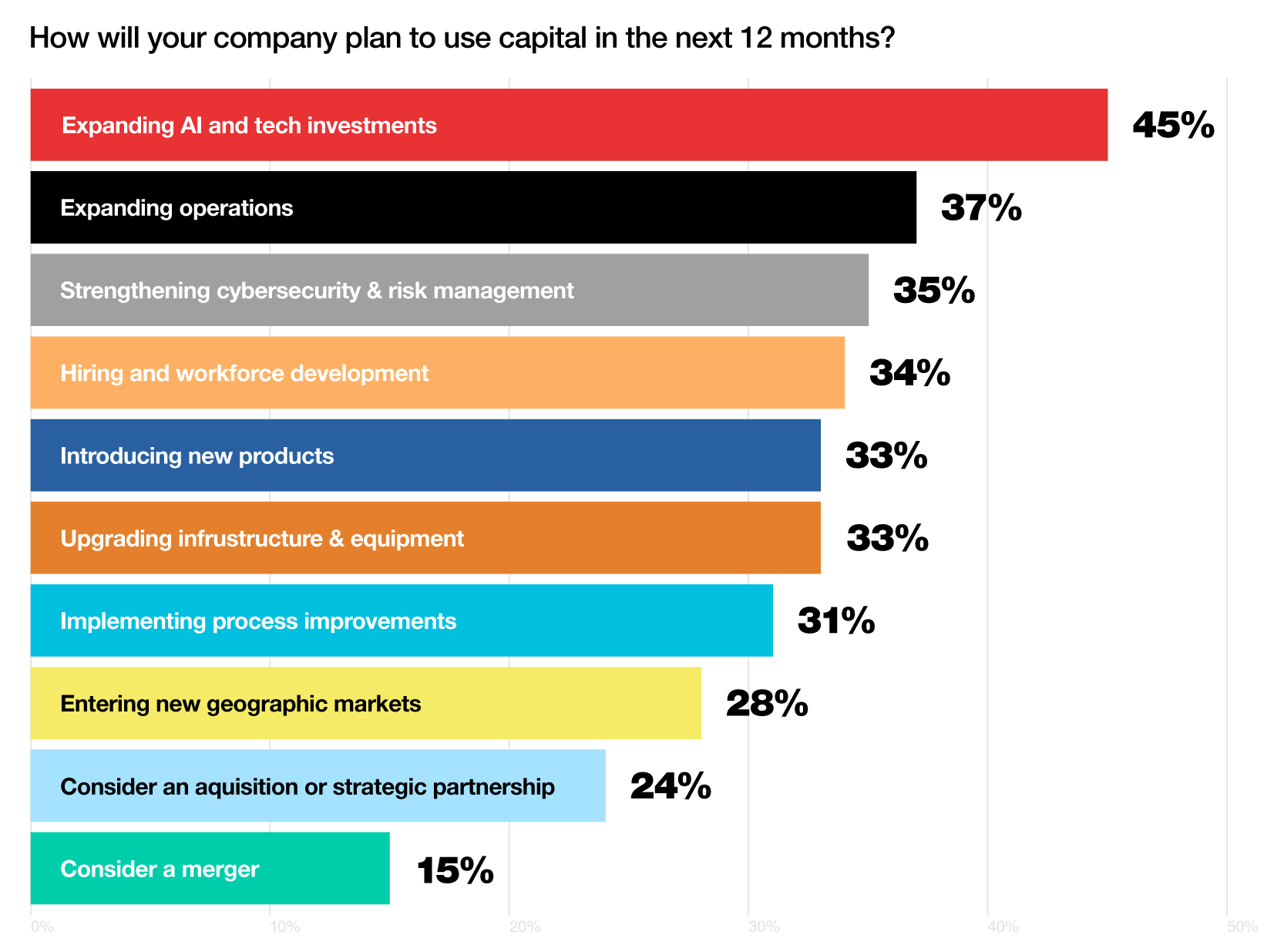

Expanding investments in AI and technology to improve efficiencies and unlock new capabilities is the top use cited for capital funding. Companies plan to utilize AI for employee tasks (i.e. chatbots for instant messaging), streamlining data entry workflows and inventory management, monitoring market conditions and identifying opportunities, among others.

Middle market leaders also seek capital to expand operations, as well as strengthen cybersecurity and risk management within their business operations. Primary efforts include anti-virus and anti-malware protections, third party security audits of information systems, implementing offsite back-up services and information storage, blocking certain types of web access and controlling site access to servers and key technologies.

GRAPH 3 – How will your company plan to use capital in the next 12 months?

Expanding AI and tech investments 45%

Expanding operations 37%

Strengthening cybersecurity & risk management 35%

Hiring and workforce development 34%

Introducing new products 33%

Upgrading infrastructure & equipment 33%

Implementing process improvements 31%

Entering new geographic markets 28%

Consider an acquisition or strategic partnership 24%

Consider a merger 15%

What it means for you

As capital flows toward digital transformation and operational efficiency, middle market leaders are prioritizing investments that support long-term business goals instead of short-term fixes. Investment choices today are supporting smarter systems, stronger safeguards, and scalable operations so companies can adapt to rapidly evolving economic conditions.

Final thoughts

U.S. middle market business leaders are pursuing technology investments aimed at improving operational efficiency, reducing cybersecurity risk, and lowering overall business costs. In doing so, they are effectively rewriting the capital playbook — blending financial discipline with forward-looking strategies that anticipate future needs and position their companies for long-term, sustainable growth.

KeyBank understands the complexity of today’s economic environment and the concerns it raises for business leaders. Our middle market experts bring deep knowledge of the evolving business landscape and the unique challenges leaders face. We offer customized insights, tailored financial solutions and real-time guidance to help you navigate uncertainty, access the capital needed for growth, and turn strategy into results.